Pre-Close

News Alert!

A beta version of the Pre-Close API is available for testing in the partner testing environment! This version covers pre-close feedback on single and two borrower purchase loans. Updated versions are expected to cover multiple borrower purchase loans, Interest Rate Reduction Refinancing Loans (IRRRLs), and Cash-out Refinance loans. Please review this page for more information.

Use the navigation buttons below to see more details on recent system activities.

Pre-Close Overview

The Pre-Close API is an optional tool that allows lenders to submit loan data and obtain feedback on the funding fee amount and loan conformance to important aspects of VA policy. The Pre-Close API may result in fewer late-breaking funding fee or other closing cost changes for the Veteran and lender, allowing them to close with increased confidence.

Pre-Close Benefits

- Introduces the opportunity to obtain feedback on the funding fee and VA loan conformance prior to closing

- May reduce financial risk to Veterans and lenders

- Allows lenders to close loans with increased confidence

- Increases data transparency

- Provides earlier detection of issues

Getting Started

The Guaranty Remittance/Pre-Close API Companion Document gives an overview of the Guaranty Remittance/Pre-Close API, including the operations and attributes.

Additional information about the input parameters can be found in the Guaranty Remittance/Pre-Close API Data Dictionary. Access the Guaranty Remittance/Pre-Close API Data Dictionary via the link below.

The UCD companion document details the fields that the Guaranty Remittance/Pre-Close API extracts from the UCD. Access the UCD companion document via the link below.

UCD Extraction Companion document

The ULAD companion document details the fields that the Guaranty Remittance/Pre-Close API extracts from the ULAD. Access the ULAD companion document via the link below.

ULAD Extraction Companion document

The technical detail of the operations and input parameters can be found in the API specification. Access the API specification via the link below.

If you already have credentials to the partner test environment, you can use those credentials. If you are a Technology Provider and were previously provided with a client ID and access to an LGY API, you can request that same account be given access to additional LGY APIs as they are made available. Submit this request by emailing the Customer Support team at api@va.gov and include your sandbox client ID and the LGY API(s) you would like access to.

The Lender aid below outlines the required steps for lenders to gain access to the partner test environment.

Download How to Obtain a Loan Guaranty API Test Account for Lenders

The Technology Provider aid below outlines the required steps for Technology Providers to gain access to the partner test environment.

Download the How to Obtain a LGY API Credentials for Technology Providers

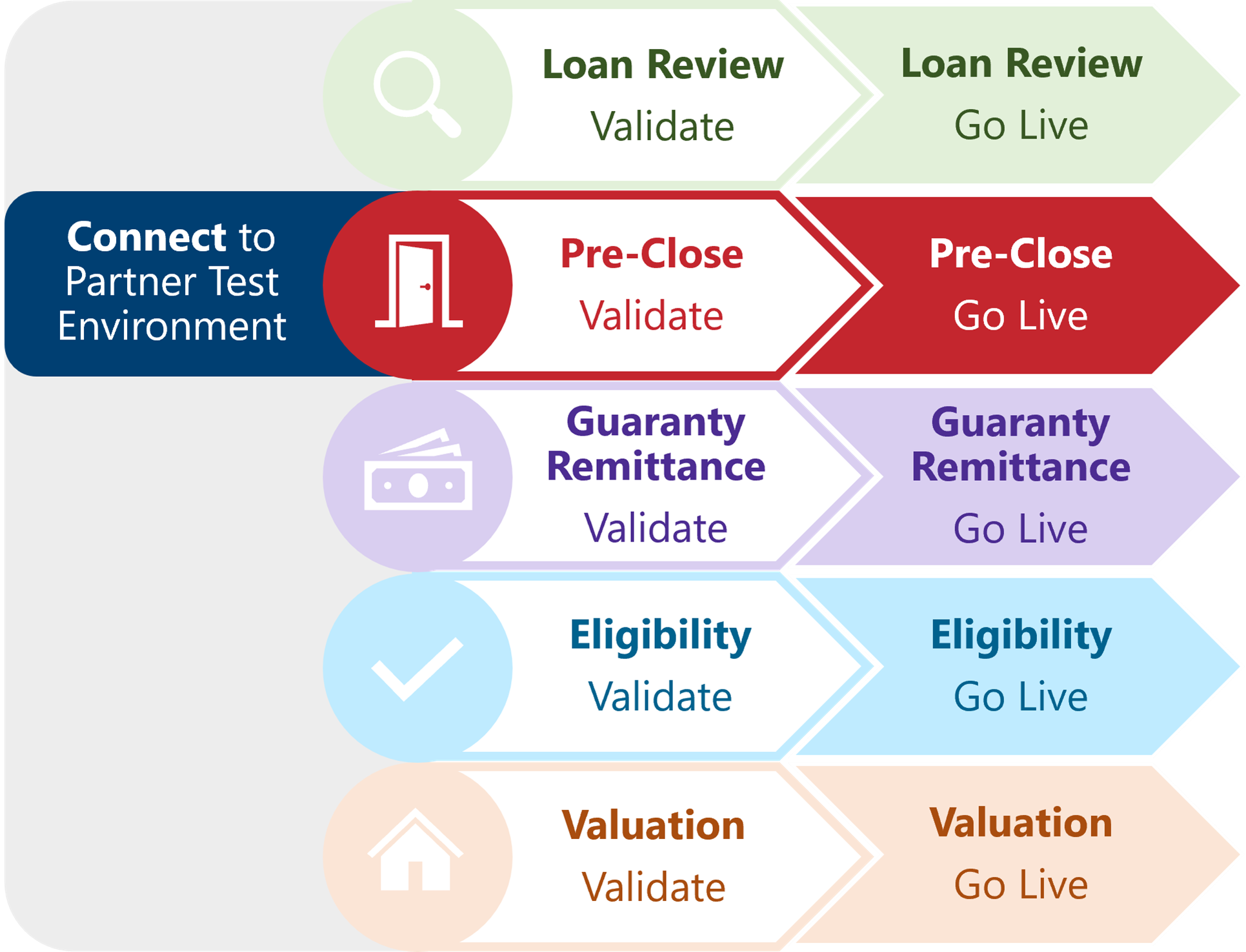

Connect

- The Pre-Close API connection can be validated once the API has been published to the partner test environment.

- If you have not already connected through an API, you will need to validate a successful connection using the Pre-Close API.

- Lenders will submit a request through the Pre-Close API and receive a response that indicates successful connection.

Validate

- Lenders will submit requests through the Pre-Close API and receive an appropriate response based on the data and scenario they are testing.

Go Live

- Lenders have the ability to submit production scenarios to the production environment.

Related Links