Loan Review

News Alert!

Per Circular 26-24-13, use of the Loan Review API to transmit Full File Loan Review (FFLR) documents to VA is required for all loans selected for a FFLR on or after November 4, 2024. As of this date, LGY will no longer accept files received via manual upload to WebLGY Correspondence in response to an FFLR request. Failure to comply could result in a lender’s inability to make VA loans.

Lenders who use a third-party Loan Origination System (LOS) should engage their technology provider in discussions regarding implementation of a Loan Review integration and encourage them to collaborate with LGY. Lenders with a proprietary LOS or a desire to build their own integration should request a discussion with the Loan Origination Transformation (LOT) API Implementation Team by visiting the LGY Help Center and selecting ‘API Support’ as the product for which you are seeking support.

Please review this page for more information.

Use the navigation buttons below to see more details on recent system activities.

Loan Review Program

The Loan Review API will allow loan files, along with the Uniform Loan Application and Closing datasets, to be submitted directly from a lender’s system to VA with the click of a button – a streamlined, simplified method with increased data accuracy that allows lenders to spend less time logging into VA systems and uploading documents, and more time providing Veterans with better, more personalized service.

Loan Review Benefits

- Enables lenders to fully automate the loan review process

- Increases data accuracy

- Enables VA to identify industry trends, benchmark performance, and engage in data driven policy initiatives that better serve our Veterans

- Frees up bandwidth for VA staff to serve Veterans by automating the manual data entry required as part of loan reviews

- Provides lenders with faster feedback on the outcomes of audits

Getting Started

The Loan Review API Companion Document gives an overview of the Loan Review API, including the operations and attributes.

API Companion Document | Provides an overview of the Loan Review API.

Additional information about the input parameters can be found in the Loan Review API Data Dictionary. Access the Loan Review API Data Dictionary via the link below.

Link to Loan Review API Data Dictionary

The UCD companion document details the fields that the Loan Review API extracts from the UCD. Access the UCD companion document via the link below.

Loan Review UCD Extraction Companion document

The ULAD companion document details the fields that the Loan Review API extracts from the ULAD. Access the ULAD companion document via the link below.

Loan Review ULAD Extraction Companion document

The technical detail of the operations and input parameters can be found in the API specification. Access the API specification via the link below.

If you already have credentials to the partner test environment, you can use those credentials. If you are a Technology Provider and were previously provided with a client ID and access to an LGY API, you can request that same account be given access to additional LGY APIs as they are made available. Submit this request by emailing the Customer Support team at api@va.gov and include your sandbox client ID and the LGY API(s) you would like access to.

The Lender aid below outlines the required steps for lenders to gain access to the partner test environment.

Download the Lender service account instructions

The Technology Provider aid below outlines the required steps for Technology Providers to gain access to the partner test environment.

Download the Technology Provider test credential instructions

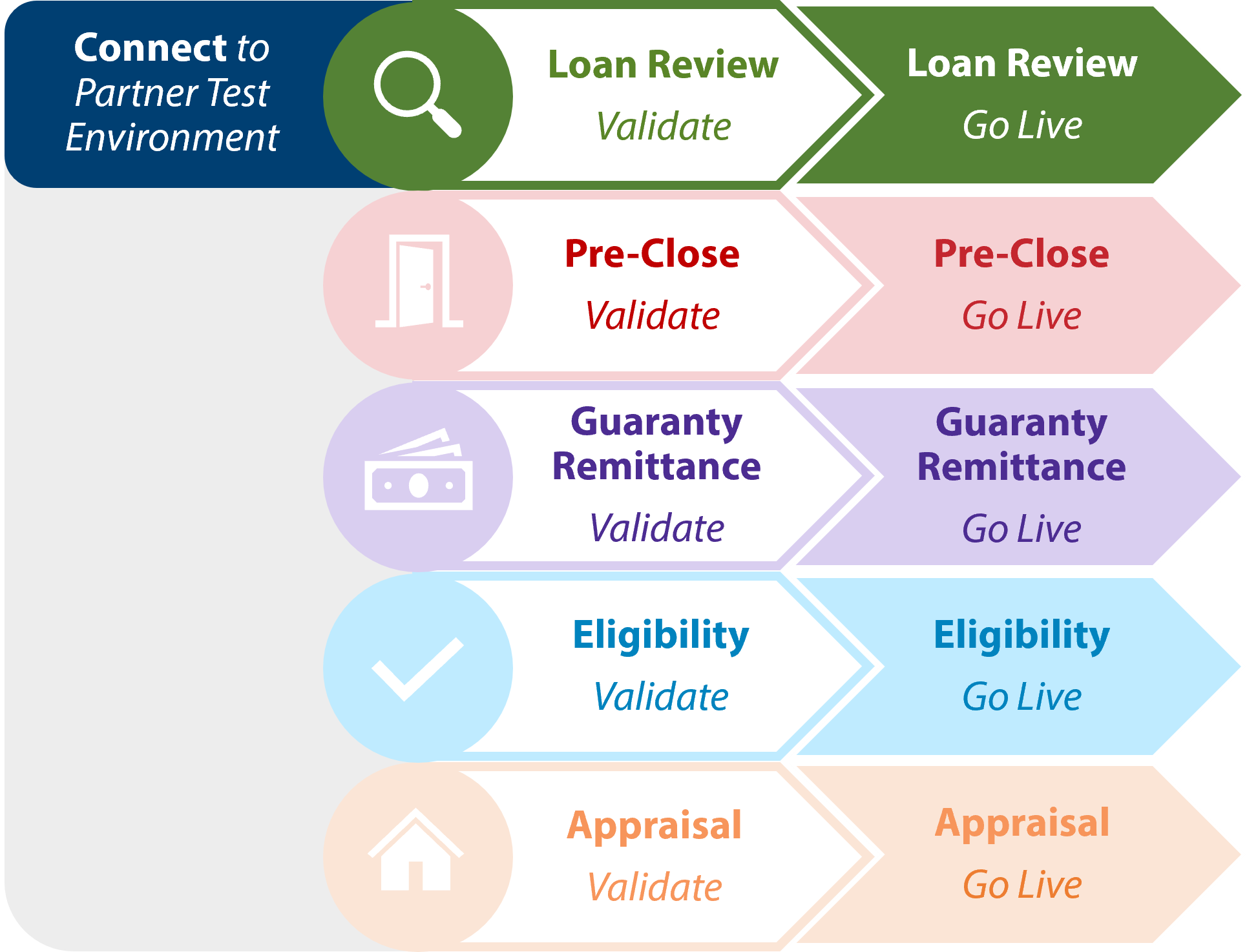

Connect

- Lenders submit UCDs, ULADs, and loan review documents for loans selected for FFLR through the Loan Review API and receive a response that indicates successful connection.

Validate

- Lenders submit loan review documents, UCD and ULAD, for loans selected for FFLR through the Loan Review API and receive an appropriate response based on the data and scenario they are testing.

- Once a lender’s LOS provider has implemented the Loan Review API or the lender has implemented their own integration in the partner test environment, lenders can execute testing at their discretion. Suggested Loan Review API test cases are outlined in the document below.

Download the Loan Review API partner test cases

Go Live

Lenders will submit production scenarios to the production environment.

Production API Account

The Lender Admin will submit a case through the LGY Help Center, selecting 'API Support' as the product and 'Request API Production Account' as the 'Category'. In the request description, you must include:

- The 10-digit home office lender ID that needs a corresponding API account/portal ID and

- An email address for the new API account.

The email address provided will receive deactivation warnings when the account is approaching 90 days of inactivity, and a deactivation notice after 90 days of inactivity. If the API account email address needs to be updated in the future, please notify VA by submitting a case through the LGY Help Center, selecting 'API Support' as the product and 'Request API Production Account' as the 'Category'. In the request description, you must include:

- The 10-digit home office lender ID associated to the API account/portal ID and

- The new email address for the API account.

Production Support

LGY Help Center, selecting 'API Support' as the product and 'Loan Review API Production Support' as the 'Category'. In the description, please include:

- Details on the issue encountered,

- Error message and screenshot,

- Lender ID,

- LIN, and

- Date and time the issue occurred.