Attention A T users. To access the menus on this page please perform the following steps.

1. Please switch auto forms mode to off.

2. Hit enter to expand a main menu option (Health, Benefits, etc).

3. To enter and activate the submenu links, hit the down arrow.

You will now be able to tab or arrow up or down through the submenu options to access/activate the submenu links.

Locator

Contact

Search

Guaranty Remittance

News Alert!

Guaranty Remittance testing will launch following the Pre-Close API release. See below for more updates on Guaranty Remittance.

Use the navigation buttons below to see more details on recent system activities.

Guaranty Remittance Overview

The Guaranty Remittance API will enable lenders to submit a closed loan for guaranty, allowing VA to evaluate the final closing disclosure and baseline loan information and provide feedback on VA policy conformance, calculate the appropriate funding fee amount, and return the Loan Guaranty Certificate (LGC) through the lender’s Loan Origination System (LOS). The API will first perform a series of data integrity checks which compare the data being submitted in the ULAD, UCD and API request against data that was previously submitted when the appraisal was ordered. Inconsistent data may result in critical errors. Additional advisory checks are then performed against VA policies and procedures. The funding fee will be calculated, payment remittance process through pay.gov initiated, and the LGC generated.

The Guaranty Remittance API is targeted for release in Q2 2025.

NOTE: VA encourages the lender community to migrate to the Application Programming Interface (API) technology, as the VA anticipates moving from the User Interface (UI) solutions in the future.

Guaranty Remittance Benefits

- Creates a simplified, one-step process for lenders to remit the funding fee, report the loan and request the Loan Guaranty Certificate

- Enables lenders to fully automate the funding fee remittance and loan guaranty request processes

- Reduces manual data entry and improves data accuracy through electronic Uniform Closing Dataset (UCD) and Uniform Loan Application Dataset (ULAD) submission

- Enables VA to identify industry trends, benchmark performance, and engage in data driven policy initiatives that better serve our Veterans

Getting Started

The Guaranty Remittance API Companion Document gives an overview of the Guaranty Remittance API, including the operations and attributes.

Additional information about the input parameters can be found in the Guaranty Remittance API Data Dictionary. Access the Guaranty Remittance API Data Dictionary via the link below.

The UCD companion document details the fields that the Guaranty Remittance API extracts from the UCD. Access the UCD companion document via the link below.

UCD Extraction Companion document

The ULAD companion document details the fields that the Guaranty Remittance API extracts from the ULAD. Access the ULAD companion document via the link below.

ULAD Extraction Companion document

The technical detail of the operations and input parameters can be found in the API specification. Access the API specification via the link below.

If you already have credentials to the partner test environment, you can use those credentials. If you are a Technology Provider and were previously provided with a client ID and access to an LGY API, you can request that same account be given access to additional LGY APIs as they are made available. Submit this request by emailing the Customer Support team at api@va.gov and include your sandbox client ID and the LGY API(s) you would like access to.

The Lender aid below outlines the required steps for lenders to gain access to the partner test environment.

Download the Lender service account instructions

The Technology Provider aid below outlines the required steps for Technology Providers to gain access to the partner test environment.

Download the Technology Provider test credential instructions

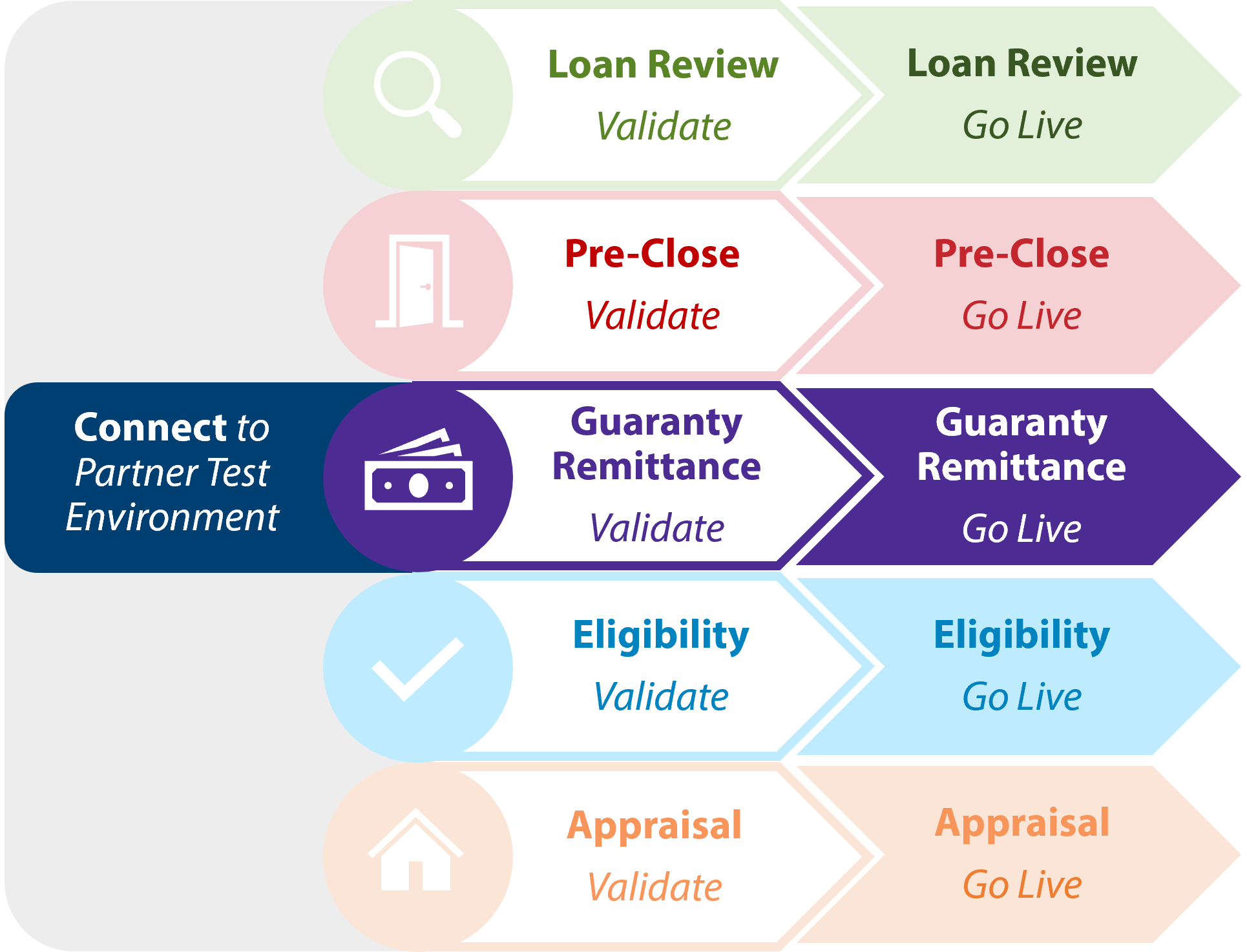

Connect

- Guaranty Remittance API connection can be validated once the API has been published to the partner test environment.

- If you have not already connected through an API, you will need to validate a successful connection using the Guaranty Remittance API.

- Lenders will submit a request for remittance through the Guaranty Remittance API and receive a response that indicates successful connection.

Validate

- Lenders will submit requests for remittance and request the loan guaranty certificate, through the Guaranty Remittance API and receive an appropriate response based on the data and scenario they are testing.

Go Live

- Lenders will have the ability to submit production scenarios to the production environment.

Related Links